Deciphering reversal patterns in Forex Trading: A Comprehensive Guide

Introduction

The realm of forex trading, or foreign exchange, unfolds as an extensive and complex space that tantalizes traders with a plethora of opportunities. The environment pulsates with ceaseless activity, offering high liquidity and round-the-clock operations, thus painting a vibrant picture of dynamism. It’s much like the evolving landscape of musical theatre, which has embraced technology and new styles to create increasingly immersive experiences for audiences.

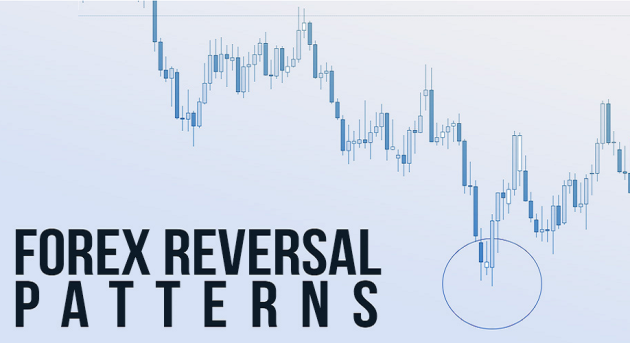

Amid this electrifying milieu, traders find themselves on an intriguing quest—deciphering clues and signals that presage the market’s trajectory. Herein, reversal patterns—critical constituents of technical analysis—emerge as key players, offering crucial insights. By signposting potential shifts in market trends, these patterns serve as vital guideposts in a trader’s journey, augmenting their ability to navigate the fluid and often unpredictable world of forex trading.

Understanding Reversal Patterns

Reversal patterns serve as crucial signals in the realm of technical analysis, offering traders a visual representation of potential market shifts. Emerging over various time frames – from minutes to months – these patterns are marked by specific configurations in price movement. They encapsulate the cyclical nature of financial markets, wherein periods of rising prices (uptrends) are eventually succeeded by periods of falling prices (downtrends), and vice versa. The accurate recognition and interpretation of these patterns can empower traders with strategic entry and exit points. Thus, mastery over reversal patterns can significantly augment a trader’s arsenal, enhancing their ability to respond swiftly and effectively to changing market dynamics.

Common Reversal Patterns

Several reversal patterns are crucial in the lexicon of a forex trader. Here, we’ll delve into some of the most commonly observed ones.

Head and Shoulders: This pattern is a reliable indicator of a potential bearish reversal during an uptrend. It gets its name from its appearance, characterized by a peak (head) flanked by two lower peaks (shoulders).

Inverse Head and Shoulders: As the name suggests, this is the inverse of the Head and Shoulders pattern, signifying a bullish reversal during a downtrend.

Double Top and Bottom: The Double Top, represented by two consecutive peaks of similar height, signifies a bearish reversal. The Double Bottom, its counterpart, is characterized by two similar lows and forecasts a bullish reversal.

Candlestick Reversals: Candlestick reversal patterns, with roots in ancient Japanese rice trading, include the Doji, Hammer, and Engulfing patterns. These patterns, revealed in single or multiple candlestick formations, often signify impending price reversals.

The Role of Trading Platforms

Understanding and identifying these reversal patterns can substantially aid forex traders in their decision-making processes. However, it’s important to remember that while reversal patterns are powerful indicators, they don’t guarantee a reversal. Like any aspect of trading, they’re based on probabilities, not certainties. Hence, it’s always advisable to corroborate pattern recognition with other forms of analysis.

Various trading sites like this one: TradingView offer advanced charting tools to help identify these reversal patterns. These platforms often feature interactive, customizable charts, real-time data, and a variety of technical analysis tools, making them invaluable resources for traders.

Conclusion

In the fast-paced, ever-fluctuating world of forex trading, having the right tools and knowledge at your disposal can significantly enhance your trading strategy. The ability to identify and interpret reversal patterns provides a valuable edge, helping traders navigate the tumultuous seas of market volatility and identify potential trading opportunities.

To conclude, reversal patterns in forex trading are crucial indicators signaling potential shifts in market trends. Trading may be inherently risky and complex, but understanding these patterns, combined with other analysis tools, can guide traders in making more informed and strategic trading decisions. Continuous learning and practice remain key, allowing traders to develop a more intuitive understanding of these patterns and how best to incorporate them into their trading strategies. So dive in, learn about reversal patterns, and use them to your advantage in the exhilarating world of forex trading!

I want to express my gratitude for sharing such an informative blog post.

This post is a breath of fresh air. You’ve managed to explain complex concepts in a simple and understandable manner.

Your post is a valuable resource for anyone looking to expand their knowledge on the topic.

Your post offers practical advice for leveraging online marketplaces like Airbnb or VRBO to rent out your property or a spare room, generating income through short-term rentals.