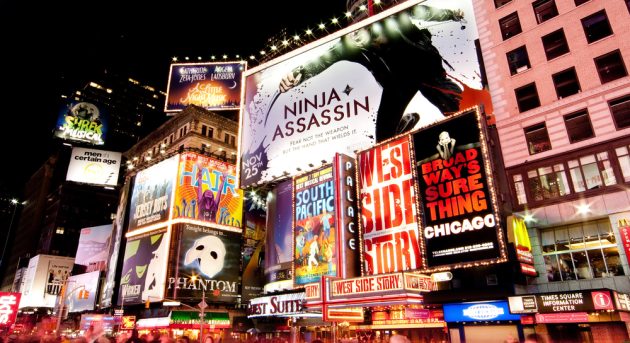

Theatre Investment – A Fusion of Passion and Potential

The allure of the theatre extends beyond the stage—it reaches into the financial portfolios of those who choose to invest in the creative arts. Amidst a backdrop of economic uncertainties, theatre investment offers both an exciting alternative to traditional asset classes and an opportunity to foster cultural enrichment.

Theatre is a sector where financial stakes are high and outcomes are as dramatic as the productions themselves. This form of investment isn’t merely about monetary gains; it’s deeply woven with a love for the arts and a desire to contribute to the vibrant cultural heritage.

Economic Impact and Investment Appeal

The theatre industry is a significant economic powerhouse, contributing billions annually to national economies. In 2023, the economic contributions of the arts and culture industries in Australia, Canada, the UK, and the US varied significantly:

- United Kingdom: The arts and culture industry in the UK made a significant contribution of £10.8 billion to the economy (Arts Council England).

- Canada: The live performance sector alone contributed $3.6 billion to Canada’s Gross Domestic Product (GDP) (CAPA).

- United States: The arts and cultural industries contributed over $1.0 trillion to the U.S. GDP, marking a substantial impact on the economy (National Endowment for the Arts).

Despite these figures, even the most illustrious productions on Broadway and the West End rely heavily on private capital to raise the curtain.

Investing in theatre is often considered the ‘fun’ part of an investment portfolio, a niche that might not align with the solemnity of traditional investments but offers a unique blend of risk and reward. This is not just an investment in financial terms but a patronage that supports the arts and enhances the cultural landscape.

The High Stakes of Theatre Investment

Neil Adleman, a prominent legal expert in theatre investment, notes that this avenue should be seen as a high-risk, high-reward opportunity. For every runaway success like Phantom of the Opera, there are many others that may not achieve financial profitability. However, the potential rewards can be substantial. It’s reported that some investors in blockbuster shows have seen returns multiple times over their initial stakes.

The Phantom of the Opera has been an extraordinary financial success since its debut. The original investors in the show have seen phenomenal returns on their initial outlays. Since its premiere in 1986, the musical has generated over $6 billion in worldwide gross receipts, with the Broadway production alone grossing over $1 billion (Wikipedia). This makes it one of the most financially successful entertainment events of all time.

The scale of return for those who originally backed the production would depend on the specifics of their investment agreements, but given the immense revenues generated, it’s clear that the returns would have been substantial. This level of success is rare in the theatre industry, illustrating why The Phantom of the Opera stands out not only as a cultural phenomenon but also as a remarkable financial investment.

The nature of these investments often attracts a specific type of investor, colloquially known as ‘angels,’ who are passionate about theatre. They are typically individuals prepared to embrace the high stakes, knowing well that the venture could yield no returns. Yet, the personal enrichment derived from being part of a theatrical production—such as attending premieres and engaging with the creative team—adds a layer of value that transcends monetary gain.

How Theatre Investments Work

The investment landscape in theatre is varied, ranging from large-scale musicals requiring millions in capital to smaller plays that might be produced on a more modest budget. Investment opportunities are usually structured in units, representing a percentage of the total production cost, allowing for a broad range of investment levels.

Many a seasoned veteran or burgeoning entrepreneur, investing in the theatre industry, should be well aware that investing in theatre is akin to backing an outsider in a race. The odds are long, but the rewards can be exceptionally gratifying for those who bet wisely. Productions like Les Misérables have shown that investments made during early stages can lead to substantial financial success as the production grows and tours internationally.

The Road to Returns

The timeline for seeing returns on a theatre investment can vary. Typically, if a production is successful, investors might begin to see returns shortly after the premiere. Unlike some other types of investments, theatre can offer relatively quick financial outcomes, provided the production achieves commercial success.

Navigating Theatre Investment

For potential investors, entering the world of theatre investment usually requires networking and connections, as many opportunities are shared through word of mouth. Regulatory frameworks mean that such investments aren’t broadly advertised, making it crucial for interested parties to engage with insiders who have access to upcoming productions seeking funding.

While the financial risks are undeniable, the cultural and emotional dividends make theatre investment uniquely rewarding. For those driven by a passion for the arts and a penchant for high-stakes ventures, theatre provides a stage not just for performers, but for investors looking to play a pivotal role in crafting tomorrow’s cultural legacy.

Photo Credit: DepositPhotos.com